Charting Your Retirement with CPF and SRS: Webinar Highlights

MSC embarked on a collaboration with PhillipCapital to bring a new webinar series – AWE Financial Health – to benefit the greater public. As seniors live through their golden years, active ageing is the key to maintaining a good quality of life. Engaging in active ageing requires a holistic approach, where multiple aspects like physical, mental, social and financial health come into play.

The webinar series seek to bring value to the seniors by exploring the new ‘Financial Health’ aspect of active ageing that has yet to be integrated in our Age Well Everyday (AWE) Programme. Having financial security allows the seniors to have the freedom to choose how they want to spend their retirement years. Hence, it is important to work towards ensuring financial health. Through the series, the team will be bringing you professional speakers to introduce key financial topics.

The inaugural topic was on how one can chart retirement using our Central Provident Fund (CPF) and Supplementary Retirement Scheme (SRS). Our featured speaker – Mr Vince Koh – has been with Phillip Securities since 2017 and is currently managing Insurance and Investment Portfolios for clients of Phillip Investor Centre (Raffles City Branch). He attained his Certified Financial Planner Certification (CFP) in 2017 and Chartered Financial Consultant (ChFC) in 2019. In 2020, he completed his Chartered Life Underwriter (CLU) with the Singapore College of Insurance.

The one-hour webinar saw a total of 54 attendees and we were glad to receive many positive feedbacks about the webinar initiative.

Watch the full recording to find out more!

KEY MESSAGES

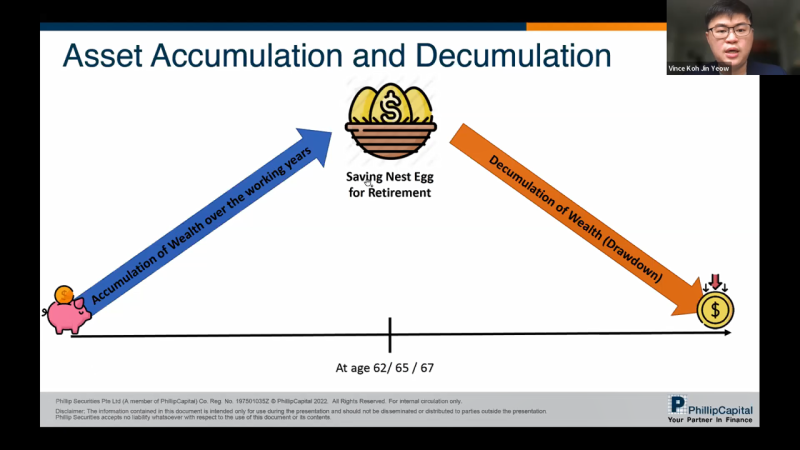

Most Singaporeans are unprepared for retirement and they are worried whether their savings are able to last them through retirement, especially with longer life expectancy.

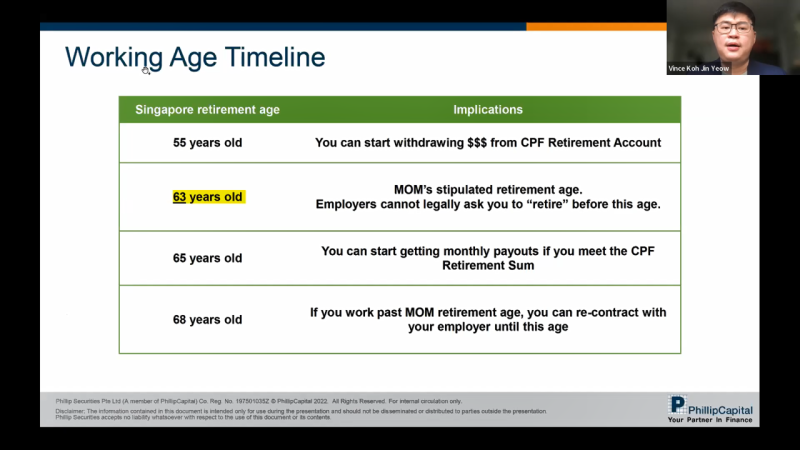

The rising prices of food and energy in 2022 has highlighted the risk of inflation that can derail your retirement journey. The journey towards retirement is made easier if you know what lies ahead and plan in advance.

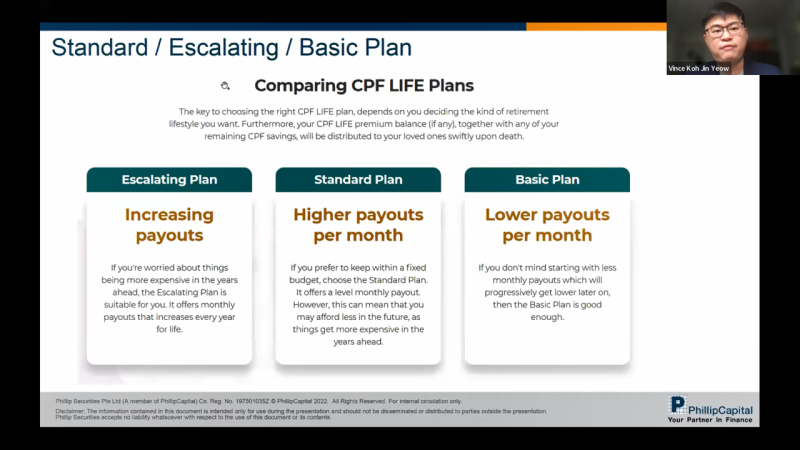

CPF Life is one of the building blocks for retirement planning. Supplementary Retirement Scheme also known as SRS is a voluntary scheme to encourage individuals to save for retirement, over and above their CPF Savings.

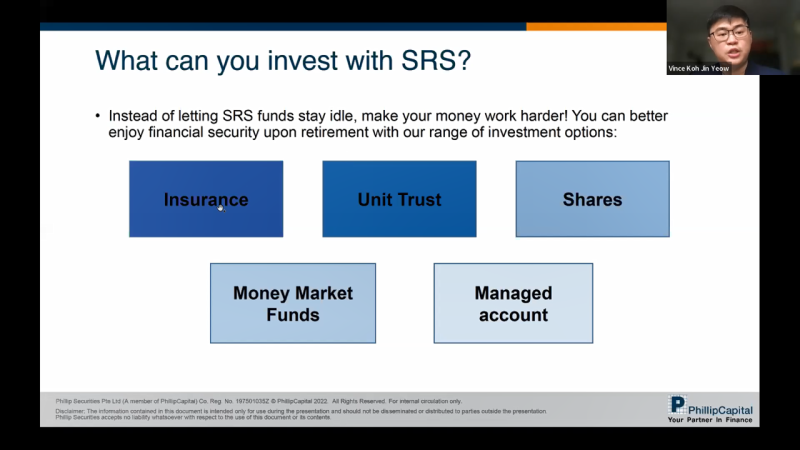

SRS is a voluntary scheme to encourage individuals to save for retirement, over and above their CPF savings. We can, in fact, save more for retirement and pay less taxes while doing so. The amount in the SRS accoung can be used for investments as well.

During the hour-long webinar, our speaker covered the key points that are good for us to note about when managing our finances through CPF Life and SRS. With financial health knowledge, we can work towards preventing inflation from eroding our purchasing power. Various investment strategies can be explored based on our own risk profile.

NEXT WEBINAR

The Importance of Will & Estate Planning

The next webinar of this series will place the spotlight on the sensitive topic of Will & Estate Planning. Writing a will is an important yet neglected part of financial planning. Some of us are unaware of the adverse consequences of not having a valid Will when we pass on, whereas the rest are simply procrastinating. Increasingly, people are more aware that it is crucial to have some arrangements made in case we are not able to make decisions on our own. Making a Lasting Power of Attorney (LPA) is absolutely important but still, there are some confusion and concerns about this.

Join our webinar on 22 October, 10am, to find out more!

MORE INFORMATION

AWE Homepage:

AWE E-Learning Portal:

SUPPORT US TODAY

Mind Science Centre is fully dependent on philanthropic support and grants to discover and co-create innovative solutions to enhance emotional resilience and cognitive performance across all ages. These efforts have touched the lives of more than 2,800 seniors, healthcare workers and youths.

As we approach the holiday season, we seek your kind and strong support to make a meaningful year-end giving. Enjoy tax deductions of 2.5 times the qualifying donation amount

Let’s make a difference to the mental health scene in Singapore!

We hope you enjoyed this webinar, and we look forward to seeing you again. Mind Science Centre has shared the video for educational purposes, in line with our goals to share knowledge and benefit the community. Please do not replicate the videos or slides without permission.

For more information and free online mental health resources, sign up for our mailing list HERE.